What Are Fundraising Tools

Fundraising tools are specialized digital platforms designed to help startups and entrepreneurs navigate the complex process of securing investment. These tools leverage AI technology, data analytics, and automation to streamline investor discovery, relationship management, and fundraising strategy execution. From intelligent investor matching to comprehensive financial reporting, fundraising tools have become essential infrastructure for modern startup funding.

The 2026 fundraising landscape features a complete ecosystem of AI-powered solutions, including investor discovery platforms, fundraising automation tools, investor relationship management systems, financial and tax tools, and market intelligence platforms. These tools not only accelerate the fundraising process but also help entrepreneurs build professional investor networks for long-term growth.

For comprehensive business development solutions, explore our Complete Guide to B2B Marketing Tools and AI Productivity Tools.

How Fundraising Tools Work

Modern fundraising tools operate through sophisticated AI algorithms and data-driven approaches that transform traditional networking into scientific, scalable processes. The core technology stack includes machine learning for investor matching, automated communication systems, comprehensive databases, and real-time analytics.

These platforms typically start by analyzing startup profiles against extensive investor databases, using AI to identify optimal matches based on industry focus, investment stage, geographic preferences, and strategic alignment. Automated workflows then handle outreach, follow-ups, and relationship nurturing, while analytics provide insights into fundraising progress and success metrics.

Best Fundraising Tools 2026

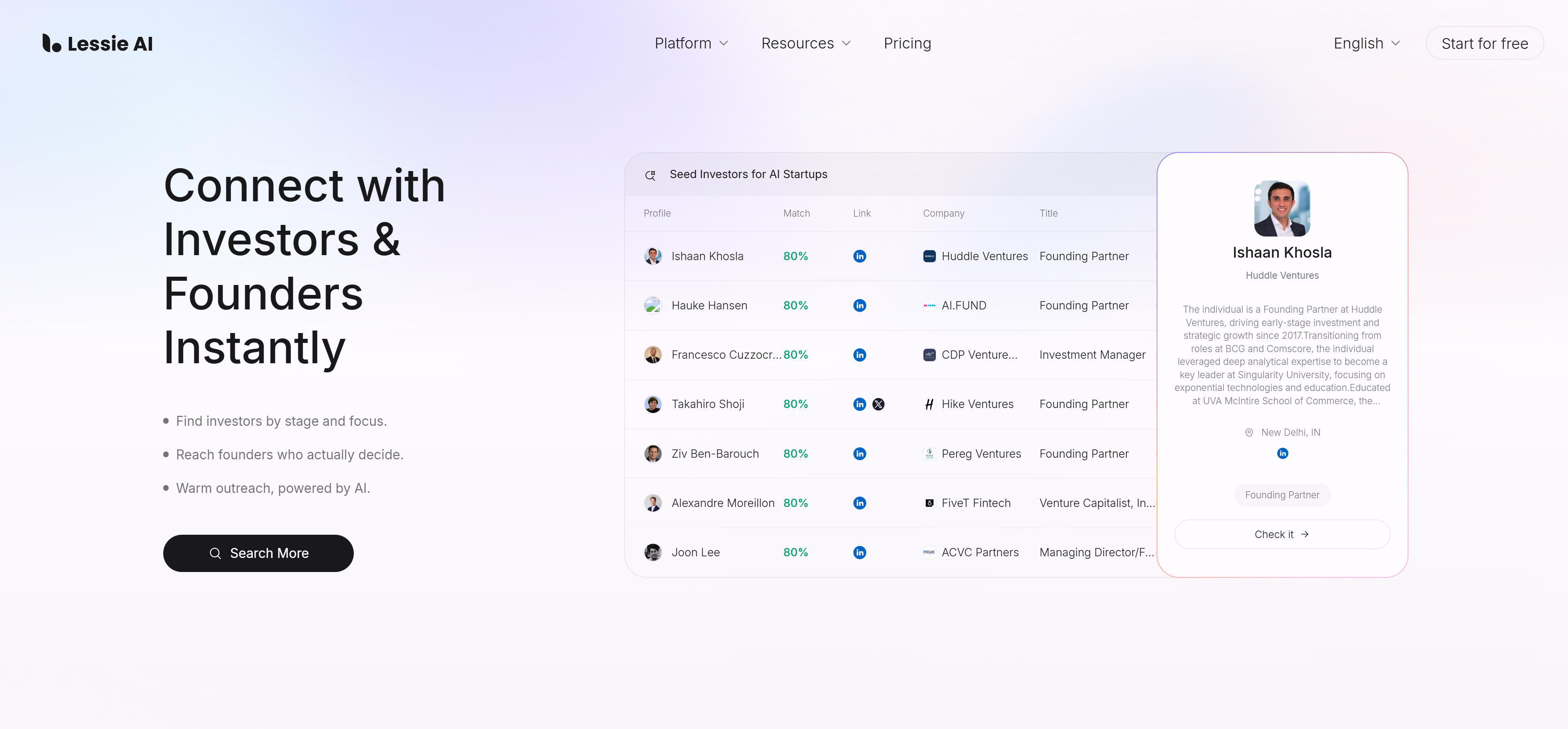

1. Lessie: AI Investor Discovery

Lessie stands out as an AI-powered investor discovery platform specifically designed for startup founders. Through advanced AI algorithms, it intelligently matches startups with the most suitable venture capital firms, angel investors, and strategic partners. The platform integrates 15+ professional investor databases, providing comprehensive investor profiles including investment preferences, past deals, and decision-making processes.

Lessie's unique value proposition lies in its ability to generate personalized outreach strategies and automate the initial contact process. Founders can filter investors by industry, stage, geography, and investment thesis, while the platform's AI provides insights into optimal timing and approach strategies. With detailed investor intelligence and contact verification, Lessie helps startups shorten their fundraising cycle by up to 50% through targeted, data-driven investor outreach.

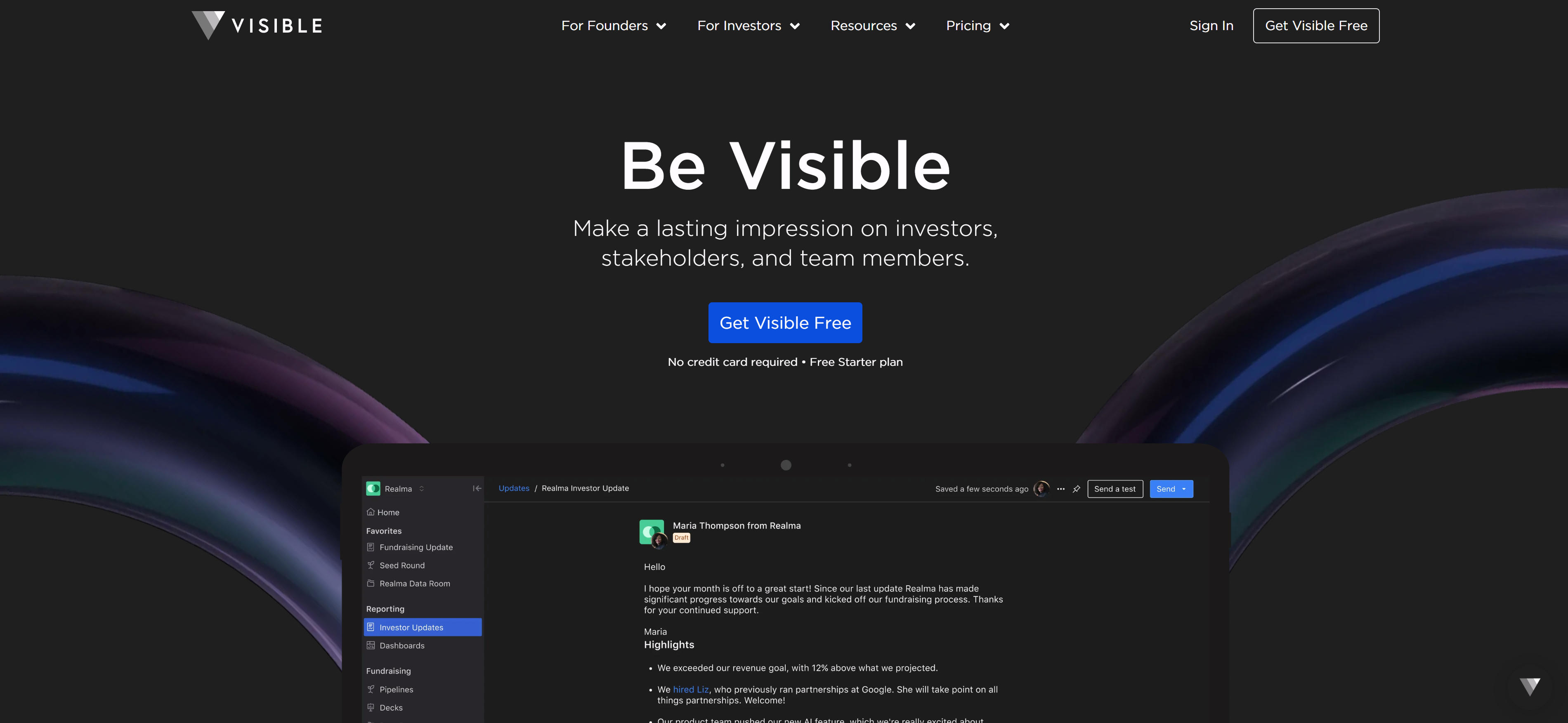

2. Visible: Investor Relations Management

Visible specializes in investor relations management, helping startups build and maintain professional relationships with their investors throughout the entire investment lifecycle. The platform provides comprehensive investor update systems, enabling regular communication through monthly reports, quarterly financials, and milestone progress tracking.

Key features include intelligent investor segmentation, personalized communication templates, and automated feedback collection systems. Visible helps early-stage companies establish professional credibility and strengthen investor trust through consistent, transparent communication. The platform's investor portal allows backers to access real-time company data and documentation, while founders can track engagement metrics and relationship strength indicators.

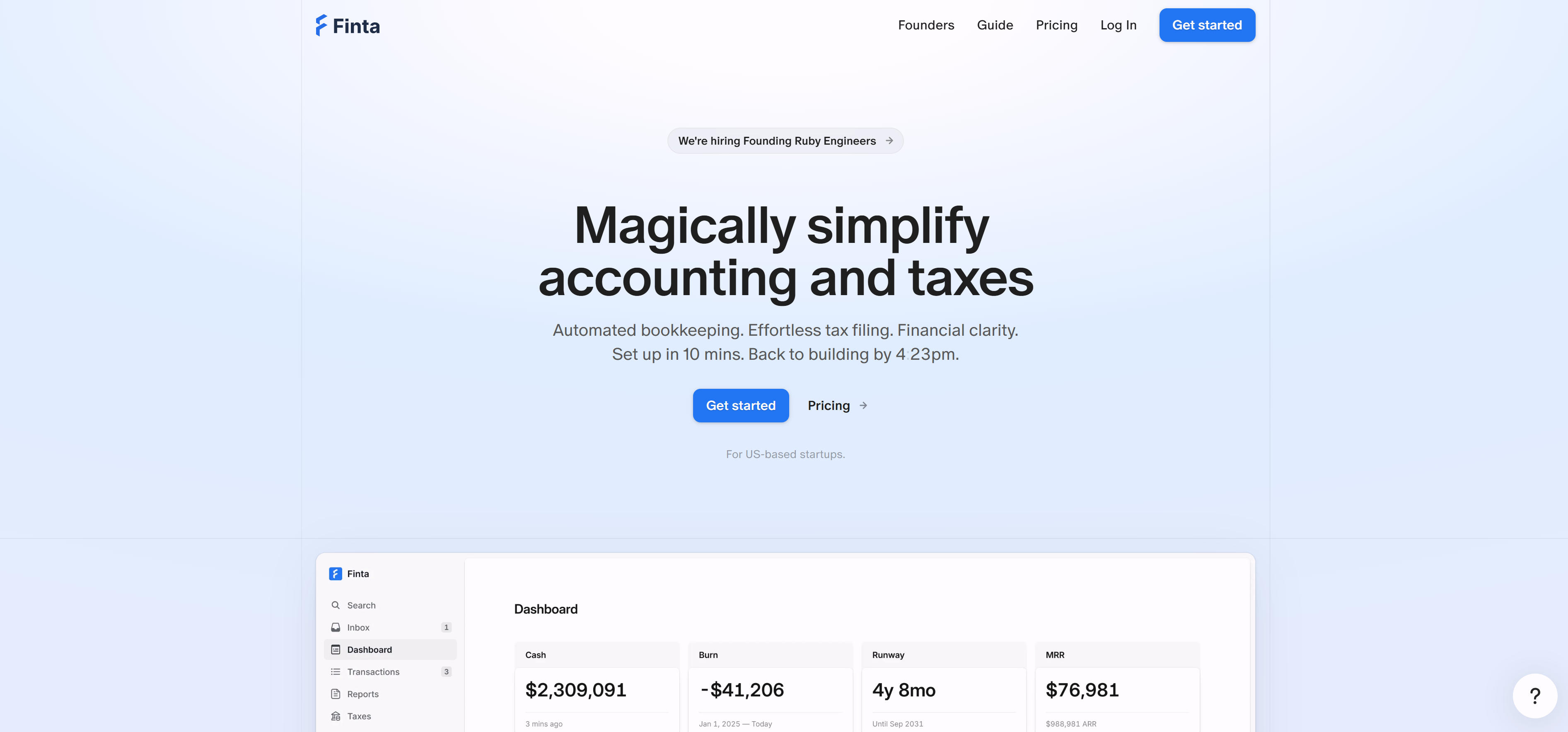

3. Finta: Startup Accounting & Tax

Finta delivers comprehensive accounting and tax automation specifically designed for startups preparing for fundraising. The platform automatically synchronizes bank accounts and financial data, providing real-time financial dashboards and cash flow projections that are essential for investor due diligence.

During fundraising phases, Finta enables rapid generation of investor-required financial reports and valuation analyses. The platform's tax services include tax planning, filing assistance, and optimization strategies tailored to startup growth stages. For companies seeking investment, Finta not only provides clear financial visibility but also builds investor confidence in the startup's financial management and governance.

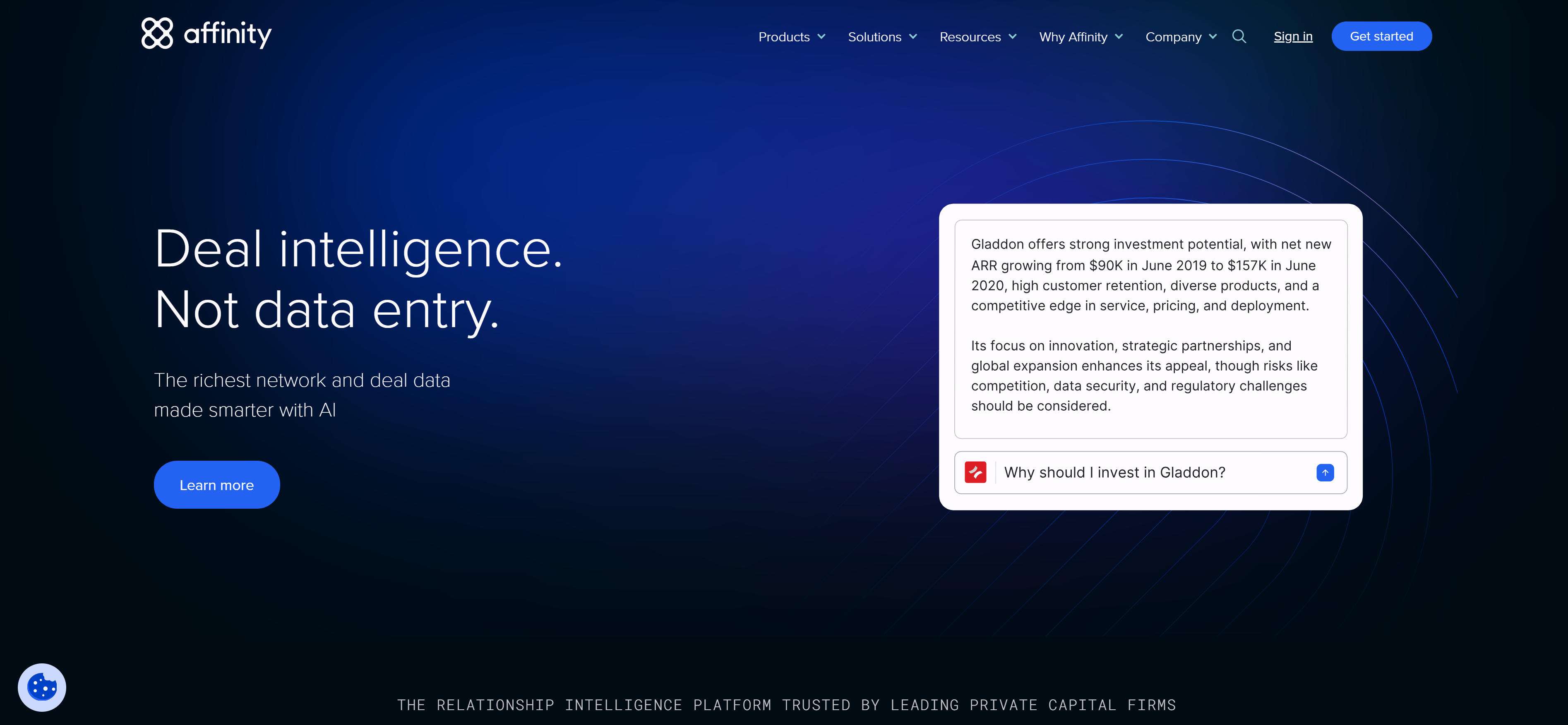

4. Affinity: Relationship Intelligence CRM

Affinity serves as an AI-driven relationship intelligence CRM platform primarily designed for venture capital firms and institutional investors. The platform automatically captures and analyzes all interactions between investors and entrepreneurs, from emails and meetings to phone conversations, creating comprehensive relationship maps within the startup ecosystem.

Through machine learning algorithms, Affinity identifies potential investment opportunities and recommends suitable startups based on investor preferences and historical patterns. The platform provides powerful data analytics for tracking portfolio performance, identifying market trends, and optimizing investment strategies. While primarily built for investors, the platform's relationship intelligence can indirectly benefit entrepreneurs by helping them understand investor priorities and decision-making processes.

5. AngelList: Startup Investment Connection

AngelList represents the world's largest startup investment connection platform, serving as the primary gateway for entrepreneurs entering the venture capital ecosystem. The platform hosts millions of entrepreneurs and investors, enabling startups to publish company profiles, funding requirements, and growth stories while allowing investors to discover and evaluate potential opportunities.

AngelList provides comprehensive company databases, detailed investor profiles, and extensive funding case studies to help entrepreneurs understand market dynamics and competitive positioning. The platform supports personalized investor targeting, communication management, and fundraising progress tracking. For early-stage founders, AngelList serves as the essential first step in fundraising, offering both investor discovery and market intelligence critical for successful funding rounds.

6. Qubit: AI Investor Matching

Qubit specializes in AI-powered investor matching, focusing on connecting startups with their ideal investment partners. The platform employs advanced machine learning algorithms to analyze startup business models, market positioning, team backgrounds, and growth trajectories, enabling precise investor matching based on compatibility and strategic alignment.

Qubit's distinctive strength lies in its sophisticated matching algorithms that consider complex parameters beyond basic demographics. The platform provides fundraising strategy consulting and pitch deck optimization recommendations, helping entrepreneurs enhance their presentation effectiveness. Particularly suited for B2B SaaS and technology startups, Qubit excels at identifying investors with deep industry knowledge and relevant investment experience, significantly improving fundraising success rates through strategic, data-driven matching.

Fundraising Tools Comparison

Use Cases: Where Fundraising Tools Excel

Fundraising tools serve critical functions across different stages of the startup funding lifecycle, from initial investor discovery to ongoing relationship management and strategic planning.

Investor Discovery & Outreach

The foundation of successful fundraising lies in identifying and connecting with the right investors. Lessie and Qubit excel in this area by using AI algorithms to match startups with investors based on industry focus, investment stage, and strategic alignment. These tools help break through the cold outreach barrier by providing verified contact information and personalized outreach strategies.

Relationship Management & Communication

Once initial connections are made, maintaining professional relationships becomes crucial for long-term success. Visible and Affinity provide comprehensive relationship management capabilities, tracking all communications, scheduling updates, and ensuring consistent investor engagement. These tools help startups build credibility and trust with their investor network.

Financial Reporting & Valuation

Clear financials are essential for investor due diligence and valuation discussions. Finta specializes in automated financial reporting and tax services, generating investor-ready documents and providing real-time financial insights. These tools help startups present professional financial information that builds investor confidence.

Pitch Deck Optimization

A compelling pitch deck can make or break a funding round. While not all fundraising tools directly create pitch decks, platforms like Qubit and AngelList provide market intelligence and competitive analysis that inform pitch strategy. They help entrepreneurs understand market positioning and craft narratives that resonate with specific investor types.

Market Analysis & Competitor Research

Understanding market dynamics and competitive landscape is essential for convincing investors. AngelList and Affinity provide comprehensive market data, competitor analysis, and industry trends that help startups build compelling investment theses and demonstrate market understanding to potential investors.

How to Choose Fundraising Tools

Select the right fundraising tools based on your startup stage, budget constraints, and specific fundraising goals to maximize your chances of securing investment.

1. Assess Your Fundraising Stage and Specific Needs

Evaluate your current fundraising phase and identify primary challenges. Early-stage startups need investor discovery tools, while companies with initial funding require relationship management solutions. Consider your industry, target investors, and timeline constraints when selecting tools.

2. Evaluate Feature Completeness and Integration

Choose tools with comprehensive feature sets that cover your entire fundraising workflow. Consider how well tools integrate with your existing systems and whether they support your preferred communication and documentation platforms for seamless operations.

3. Prioritize Data Security and Compliance

Fundraising involves sensitive financial and strategic information. Verify that tools meet enterprise-grade security standards, comply with relevant regulations, and provide clear data handling policies to protect both your startup data and investor information.

4. Analyze Cost Effectiveness and ROI

Compare pricing models against expected benefits. Free tiers may suffice for basic needs, while premium tools justify their cost through time savings and improved success rates. Calculate potential ROI based on accelerated fundraising timelines and increased success probabilities.

5. Test User Experience and Support Quality

Evaluate interface intuitiveness and learning curve requirements. Test customer support responsiveness and quality, especially during critical fundraising periods. Consider user reviews and case studies to validate real-world effectiveness.

Conclusion

The 2026 fundraising tools landscape offers a comprehensive ecosystem of AI-powered solutions that transform traditional networking into data-driven, scalable processes. From intelligent investor discovery platforms like Lessie and Qubit to relationship management systems such as Visible and Affinity, these tools provide essential infrastructure for modern startup funding.

Selecting the right fundraising tools requires careful consideration of your startup's current stage, specific needs, and long-term goals. Early-stage companies should prioritize investor discovery and outreach capabilities, while more mature startups need robust relationship management and financial reporting tools. The key is choosing solutions that integrate well with your existing processes and provide measurable improvements to your fundraising efficiency and success rates.

As AI continues to reshape the venture capital ecosystem, entrepreneurs who embrace these technological advancements will gain significant competitive advantages in securing the funding needed to fuel their growth and innovation.